We provide advice on general insurance products, to help you protect your assets and liabilities to minimise the financial impact when things go wrong.

Recommendations based on your circumstances and needs

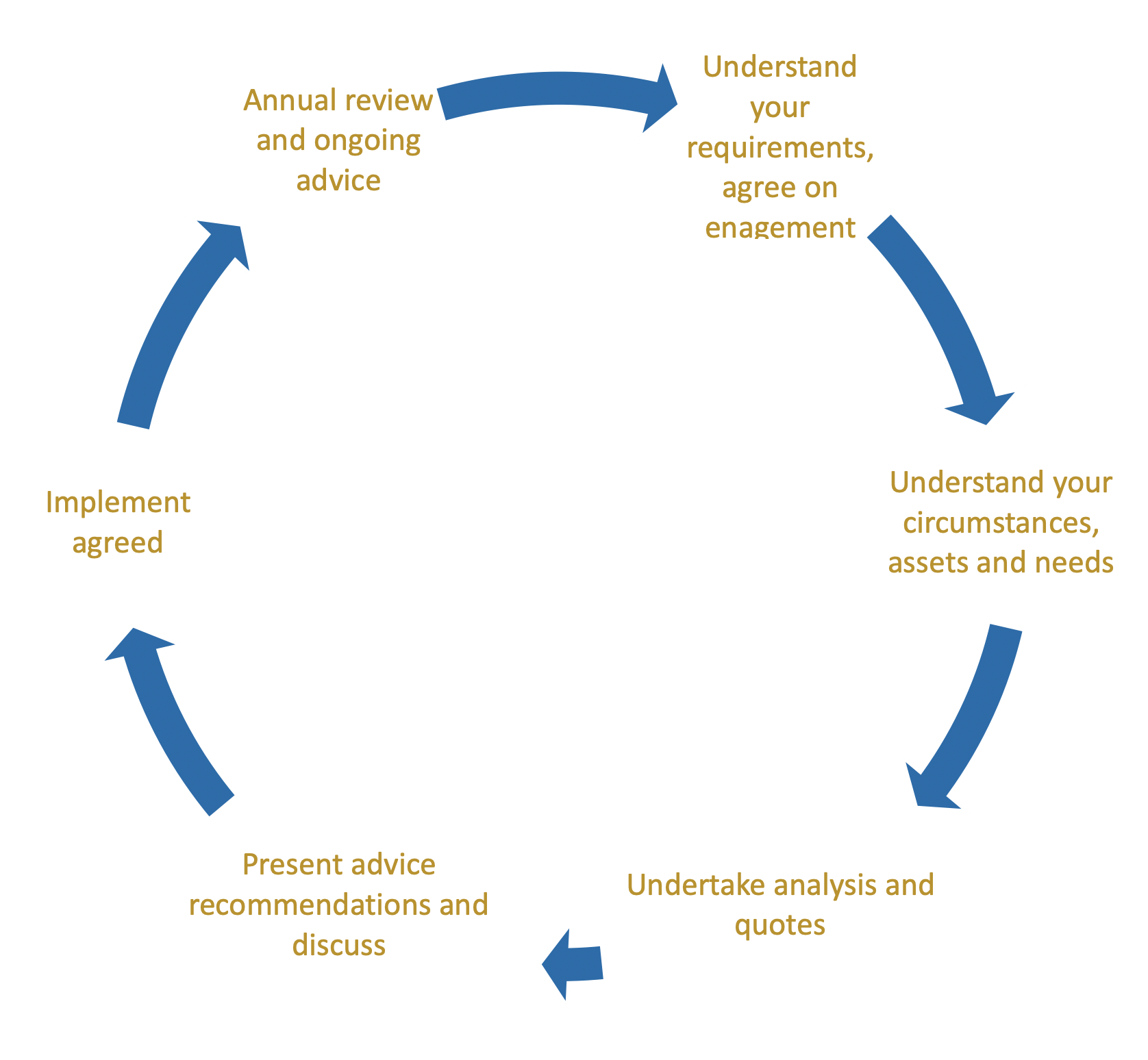

We will complete a needs analysis with you to understand your business circumstances and make recommendations to provide you with adequate cover. An example of our process is shown below

Insurance products and providers

Following our discussions, we have agreed to provide details on the following commercial insurance products:

- Property

- Commercial Vehicle

- Travel

- Engineering/Contract Works

- Forestry

- Boat Insurance

- Business Interruption

- Trade Credit

- Business Liability

- Event Cancellation

- Mobile Plant

- Marine Cargo

What we don’t advise on

We are a Financial Advice Provider licenced to provide advice on General Insurance products. We do not provide advice on medical or life insurance, or any other Financial Advice products.

Limitations and risks

Insurance cover recommendations will be based on the information you provide and there will be a risk of lack of cover should the information you provide not be accurate.

While our recommendations will be made for your requirements, insurance products can have a number of exclusions that you should be aware of and you must read the policies carefully.

Circumstances Change

As your circumstances change (e.g. as you acquire new assets) it is important that you notify us to ensure the cover still meets your needs.